Feeling like life is a rollercoaster ride with so many roles to juggle? No worries! I've got the key to bringing order and balance into the chaos. Let's explore 7 game-changing lists that will rock your world and keep you on top of your game as a business owner, homemaker, and self-care advocate.

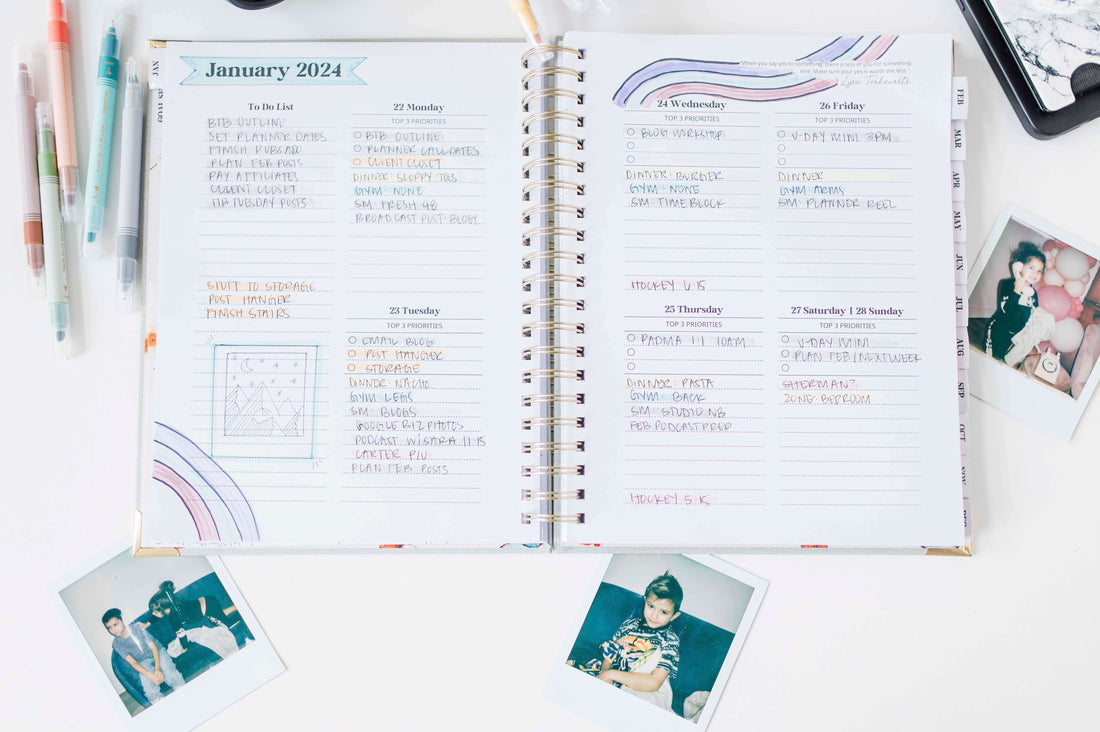

I'm using the Capture The Chaos planner to organized my lists. Shop for you planner here.

1. Daily and Weekly

We all have endless to-do lists, but not everything on them is equally important. That’s where the Matrix System comes in. This system helps you prioritize tasks based on urgency and importance so you can focus on what really matters.

Here’s how it works:

- (1) Important & Urgent: Do it now (e.g., client deadlines, paying bills).

- (2) Important but Not Urgent: Schedule it (e.g., long-term projects, planning content).

- (3) Not Important but Urgent: Delegate it (e.g., grocery shopping, responding to routine emails).

- (4) Not Important & Not Urgent: Eliminate it (e.g., time-wasting tasks).

Pro Tip: Set aside some time for a weekly empty-out session to write down your to-do list using this method. This keeps you from feeling overwhelmed and ensures that you’re focusing on tasks that push the needle forward.

2. Goals

Setting goals isn’t just about your career—true balance comes from addressing every aspect of your life. To create well-rounded goals, focus on these 8 areas:

- Business: What steps will help you grow your business or career?

- Physical: What do you need to do to stay healthy and fit?

- Mental: How can you keep your mind sharp and manage stress?

- Spiritual: What practices help you stay grounded and aligned with your values?

- Social: How can you nurture friendships and grow your community?

- Family: How will you prioritize time with your loved ones?

- Money: What financial goals will help you feel secure and empowered?

- Hobby: What hobbies or passions will you make time for just because they bring you joy?

Write out your goals for each of these areas, breaking them down into manageable action steps that you can review weekly.

3. Shopping Lists

A simple shopping list can be a lifesaver for staying organized. Break your list down by categories (e.g., groceries, household items, business supplies) so it’s easy to reference and doesn’t feel overwhelming.

Here’s a quick template you can use:

- Groceries: Include staples and weekly meal ingredients.

- Household Items: Laundry detergent, toiletries, etc.

- Business Supplies: Printer ink, office supplies, etc.

Pro Tip: Keep a running list on your phone so you can quickly add items when you run out.

4. Meal Planning

Meal planning not only saves you time and money but also helps you avoid the stress of figuring out what’s for dinner last minute. Start by planning meals for the week and create a list of ingredients you’ll need.

Here’s an easy meal-planning system:

- Choose 3-4 repeating weekly dinners: Select meals you want to cook and make sure to include family favorites.

- Experiment: Try a few new recipes to add variety

- Repurpose leftovers: Plan for leftover night to save time.

- Prep in advance: Set aside time on the weekend to prep ingredients.

By organizing your meals, you’ll have more brainpower for other tasks and avoid those last-minute takeout orders!

5. Budget

Creating a budget is an essential part of managing your finances effectively. By developing a monthly budget, you can gain a clearer understanding of your financial situation and take control of your money. Start by listing all of your sources of income, including your salary, bonuses, and any other earnings. Next, make a comprehensive list of your fixed expenses, such as rent or mortgage payments, utility bills, insurance premiums, and loan payments. Don't forget to include variable expenses, such as groceries, dining out, entertainment, and other discretionary spending. Having a detailed breakdown of your income and expenses will help you to identify areas where you can save money and make informed financial decisions.

Here’s a basic budget template:

- Income: List all sources.

- Fixed Expenses: Rent/mortgage, utilities, insurance, etc.

- Variable Expenses: Groceries, dining out, gas, etc.

- Savings Goals: Emergency fund, vacation, retirement, etc.

By regularly reviewing your budget, you’ll know exactly where your money is going and can adjust as needed to reach your financial goals.

6. Cleaning

Create a cleaning list is a helpful way to manage household chores and prevent feeling overwhelmed. It's useful to categorize tasks into daily, weekly, and monthly responsibilities.

- Daily: Wipe down counters, make the beds, do a quick declutter.

- Weekly: Vacuum/mop floors, clean bathrooms, do laundry.

- Monthly: Deep clean appliances, declutter closets, dust hard-to-reach areas.

Use this system to prevent your cleaning from piling up and taking over your weekends.

7. Important Dates

Lastly, keep track of important dates to ensure you never miss a birthday, anniversary, or appointment. Whether you use a planner, digital calendar, or wall calendar, here’s what to include:

- Birthdays/Anniversaries: Mark important dates for friends and family.

- Appointments: Doctor, dentist, and business meetings.

- Events: Kids' activities, business launches, or family vacations.

Regularly review your list of important dates so you can plan ahead and avoid double-booking or forgetting key events.

By using these seven lists—daily to-dos, balanced goals, shopping lists, meal planning, budget, cleaning, and important dates—you’ll feel more organized and in control of your life. It's not about perfection but about creating systems that support you in managing your busy schedule while finding balance in the areas that matter most.

Ready to get oranized this year? Shop The Capture The Chaos planner here.